The loan estimate and the closing disclosure are two of the most important documents you review and sign when buying a home. The loan estimate provides detailed information about your lender’s mortgage offer, while the closing disclosure presents the final loan terms and costs. Both documents require careful examination to fully understand the interest rate on your loan, the closing costs, and the total amount needed to close the sale.

Key Takeaways:

- Loan estimates allow you to compare mortgage details from different lenders before committing, but it’s essential to remember that estimates can change.

- A closing disclosure is a document your lender provides with details of your final closing costs, monthly mortgage payments, and cash needed to close.

- It’s important to compare your loan estimate and closing disclosure to make sure you understand the changes to your loan offer before you accept them at closing.

What Is a Loan Estimate?

The loan estimate is a standardized document that outlines the mortgage terms the lender expects to offer you. It includes the loan amount, the loan term, the interest rate, your closing costs, and your expected monthly payment. Keep in mind the loan estimate is just an estimate, and the numbers can change.

Your mortgage lender is required by law to provide you a loan estimate within three business days of receiving your mortgage application.

It’s a good idea to apply with several lenders and compare loan estimates to find the best mortgage for you.

How To Get a Loan Estimate

To get a loan estimate, you need to contact a lender, apply for a mortgage, and submit the required documents. To create a loan estimate for you, the lender will need:

- Your name

- Your income

- Your Social Security number

- The home’s address

- The estimated value of the home

- The desired loan amount

Loan estimates can be revised if there’s a change of circumstances, such as an update to the loan amount or the loan type, or adjustments to your income, credit score, or employment status.

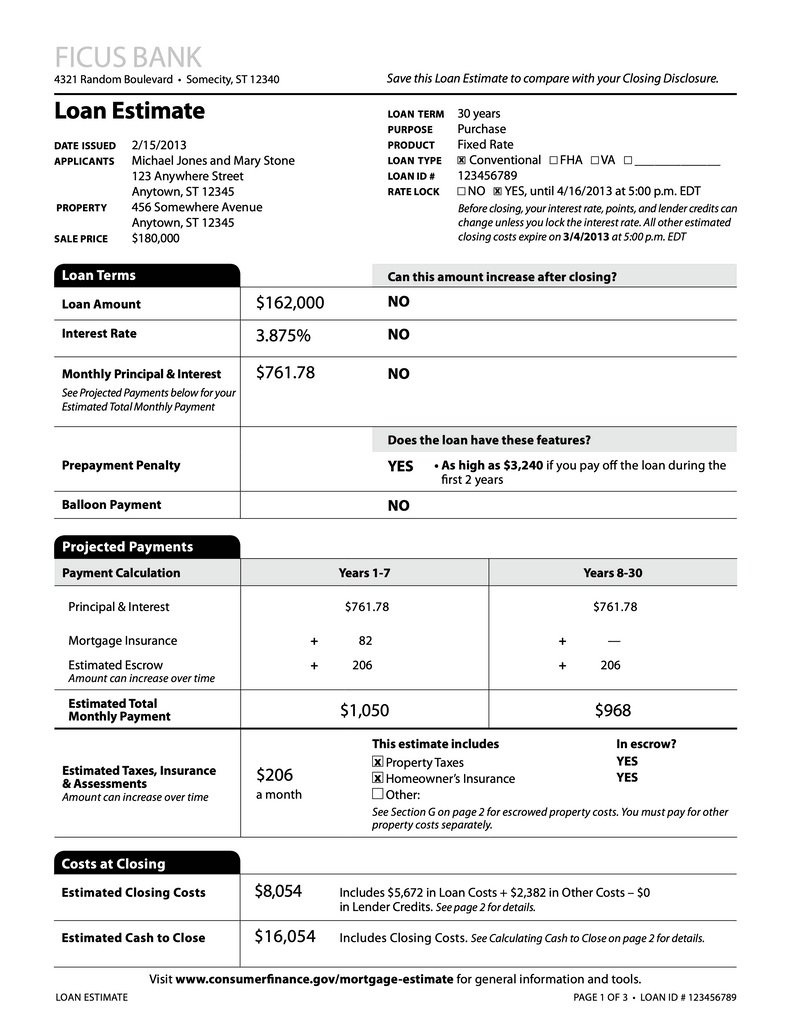

Understanding Your Loan Estimate

Lenders use a standardized loan estimate form that makes it easy for borrowers to understand and compare mortgage offers.

Here’s a page-by-page guide to the loan estimate.

Page 1

This page covers the basics of the loan you applied for and includes the loan term, loan type, interest rate, loan amount, estimated monthly payments for the mortgage and escrow costs, estimated closing costs, and estimated amount of cash needed to close.

Page 1 clearly indicates which fees can and cannot change before closing.

Important things to check for accuracy include:

- Borrower information. Verify your name and the address of the property you’re buying.

- Loan information. This includes the number of years you’ll be repaying the loan, whether you’re using the loan to buy or refinance a home, whether your loan has a fixed or adjustable interest rate, and the loan type.

- Interest rate. This is the interest rate you’ll be charged for the loan.

- Rate lock. If you chose a rate lock, this section confirms it and states when the lock expires.

- Loan amount. Make sure the amount you’re borrowing is correct.

- Prepayment penalties. This section will say whether the lender can charge a penalty if you pay off the loan early.

- Balloon payments. A balloon payment is a lump sum — often quite large — that is required at the end of the loan term to fully pay off the loan.

- Estimated total monthly payment. Confirm this is in line with what you can afford to pay on an ongoing basis. This may show how much estimated property taxes, homeowners insurance, and other assessments would add to your loan payment if you choose to pay them with an escrow account.

- Estimated cash to close. You need to have this much cash on hand to close the sale.

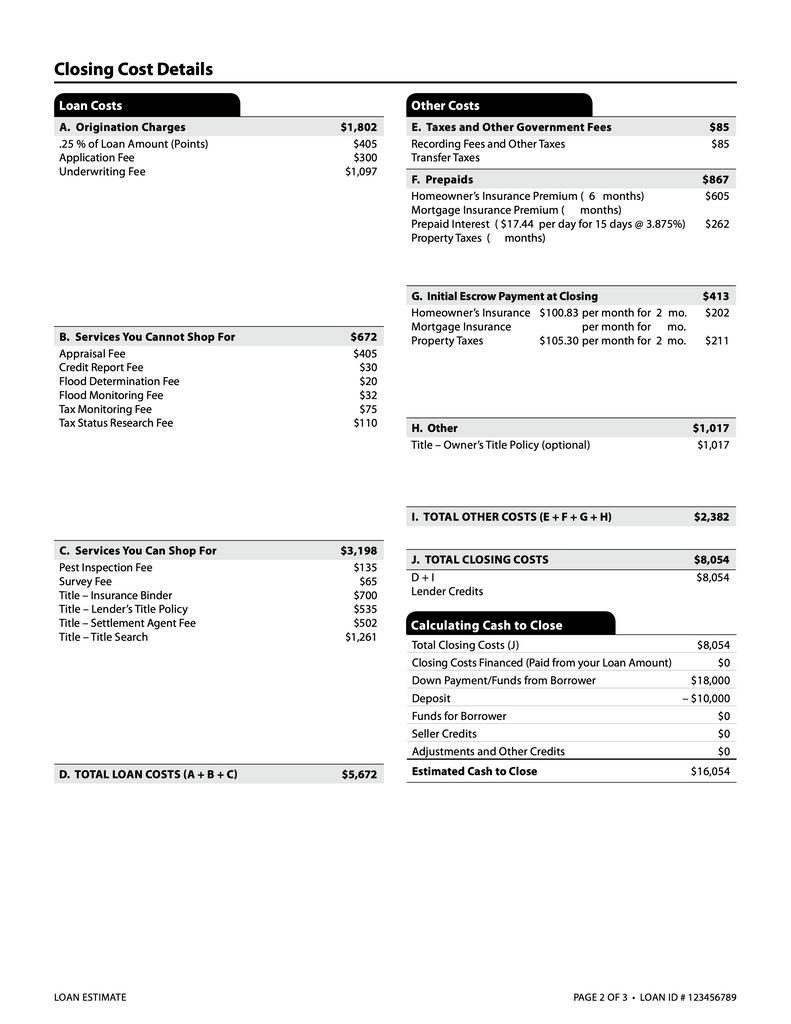

Page 2

This page lists all your closing costs and estimates how much they will be. This includes:

- Loan costs. This includes origination fees, application fees, and underwriting costs.

- Closing costs you can shop for. Examples include title search fees and title insurance.

- Closing costs you cannot shop for. This includes appraisal fees, credit report fees, tax research fees, and flood determination fees.

- Taxes and government fees. Recording fees and transfer taxes are included here.

- Prepaid fees. This covers partial payments on homeowners insurance, property taxes, private mortgage insurance, and interest.

- Initial escrow payments. These fees typically cover the first few months of payments into escrow for homeowners insurance and property taxes.

Page 2 also calculates the cost to close, which is how much you need to pay at closing to buy the home.

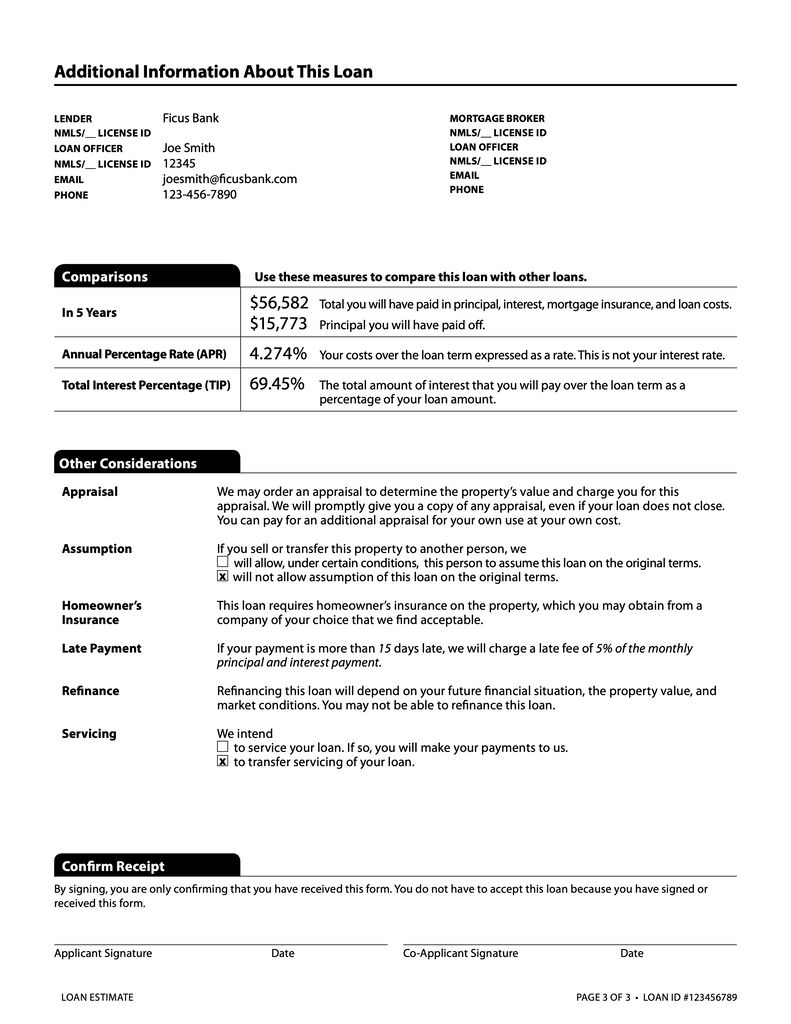

Page 3

The final page of the loan estimate includes a comparisons section that details how much interest you’ll pay over the life of the loan, the annual percentage rate, and the total interest percentage.

APR represents the annual cost of a loan and includes the loan’s interest rate, broker fees, discount points, and any other charges attached to obtaining the loan. That means the APR typically is a higher number than the interest rate. The main limitation of APR is that it does not reflect the maximum interest rate for an adjustable-rate mortgage, or ARM.

Lenders will state here any required penalties and grace periods for missed or late payments. This page also explains whether your lender will allow another party to assume the loan and if your lender intends to service the loan itself or transfer it to another company.

Page 3 ends with an area where the borrower signs to confirm receipt of the estimate. Your signature here confirms that you received the document, not whether you accept the loan.

Download a sample loan estimate form here.

How To Compare Loan Estimates

Consumers who get loan estimates from multiple lenders save more money. Comparing loan offers from multiple lenders can save borrowers $600 to $1,200.

As you receive loan estimates, it may be helpful to keep track of them with a spreadsheet. That can make it easier to compare them based on factors such as:

- Loan type. The terms of a mortgage vary based on whether you’re applying for a conventional loan, a jumbo loan, a Federal Housing Administration loan, a Veterans Affairs loan, or a U.S. Department of Agriculture loan.

- Rate type. The interest rate type will be fixed or adjustable.

- Loan term. The term is how long it will take to repay the loan, usually 15 or 30 years.

- Loan amount. This should be the purchase price minus your down payment.

- Discount points. You can reduce the interest you pay on your loan by paying some of it in advance. This is called buying discount points.

- Lender credits. Lender credits involve the lender reducing your closing costs in exchange for charging you a higher interest rate.

- Rate lock period. This keeps the interest rate your lender is offering from changing for a set amount of time, typically 30 to 60 days.

How To Accept a Loan Estimate

You typically have 10 business days after receiving a loan estimate to tell your lender you intend to proceed with the loan. If your lender fails to hear from you by then, your application typically is marked incomplete, and you would need to start over with a new loan estimate.

What Is a Closing Disclosure?

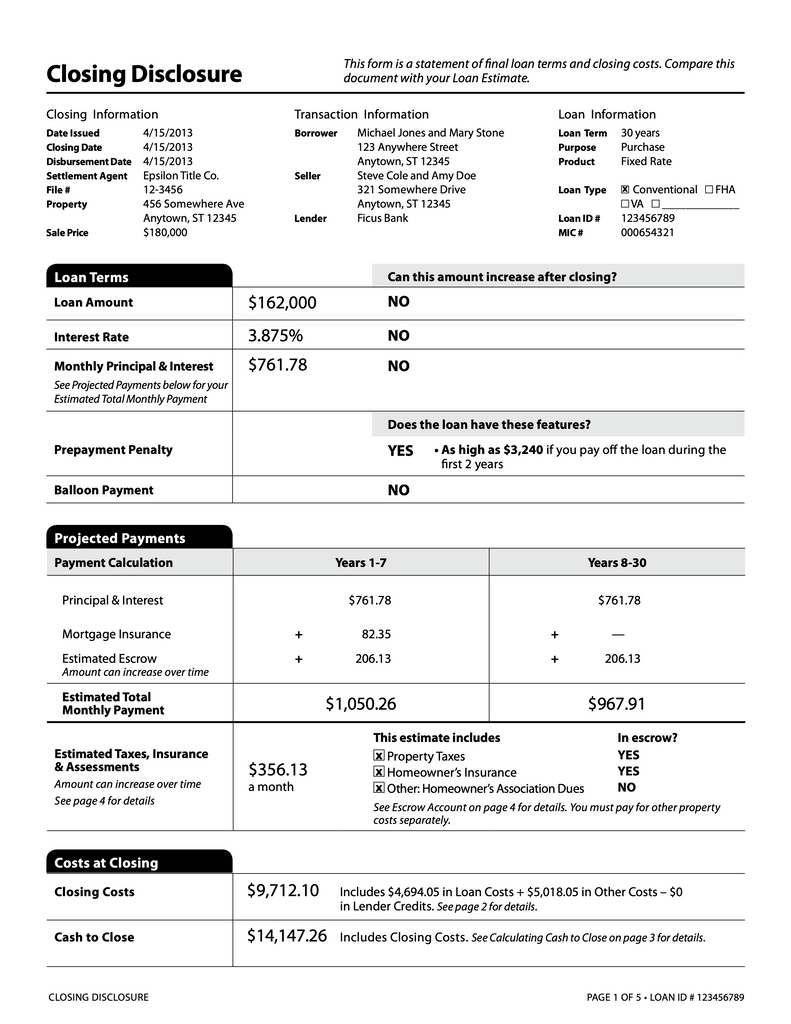

After you accept a loan offer, your lender begins underwriting, which involves verifying your finances and your ability to repay the loan. At least three business days before your closing date, your lender will provide the closing disclosure document with finalized loan terms.

The closing disclosure will confirm your final closing costs and monthly mortgage payment, and how much cash you will need to close the sale.

Understanding Your Closing Disclosure

The closing disclosure is a standardized five-page document that includes the final details of your loan offer. Each page contains information that needs to be reviewed and understood before you sign your closing documents. It’s important to compare your closing disclosure with your loan estimate.

Page 1

Page 1 of the closing disclosure summarizes your loan terms, projected payments, and costs at closing. It includes:

- Borrower and seller information. These are the names and addresses of the buyer and seller.

- Loan information. This is the loan term, the loan type, and whether it’s for a purchase or refinance.

- Loan amount. This is how much you’re borrowing.

- Interest rate. This is the interest rate you’re agreeing to for the loan.

- Estimated monthly payment. This is what you pay to cover your mortgage principal and interest.

- Prepayment penalty. If you have one, it will be explained here.

- Balloon payment. If you have one, it will be explained here.

- Estimated taxes, insurance, and assessments. These include payments for homeowners insurance, property taxes, homeowners association dues, and whether those fees are being paid with an escrow account.

- Closing costs. These are loan costs, taxes and government fees, real estate agent commissions, and other fees that need to be paid to close the transaction.

- Cash to close. This is the amountyou need to pay at closing.

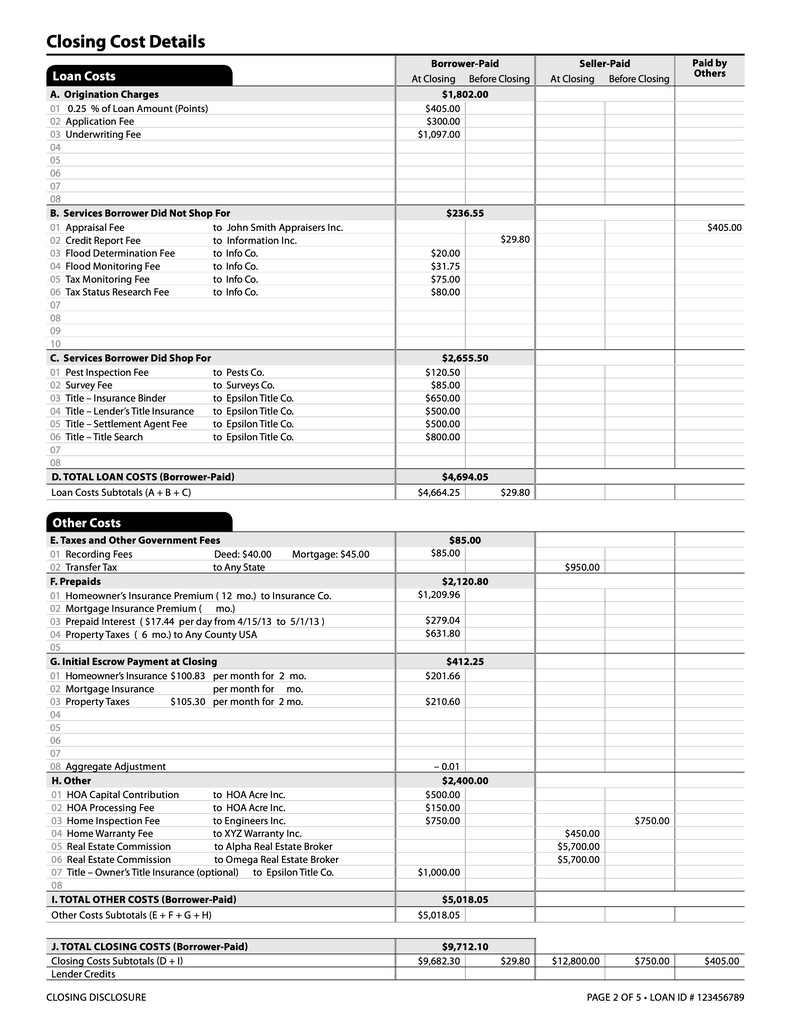

Page 2

Page 2 features an itemized list of closing costs. For loan costs, it lists lender fees, services you shopped for, and those you did not shop for. These services can include origination costs, appraisal fees, home inspection fees, and title fees.

It’s important to confirm these costs are accurate and that you understand the fees you’re paying.

Here’s what an itemized list of some of these costs might look like:

- Loan points

- Application fee

- Appraisal fee

- Credit report fee

- Flood determination fee

- Tax monitoring fee

- Tax research fee

- Survey fee

- Title insurance

- Inspection fee

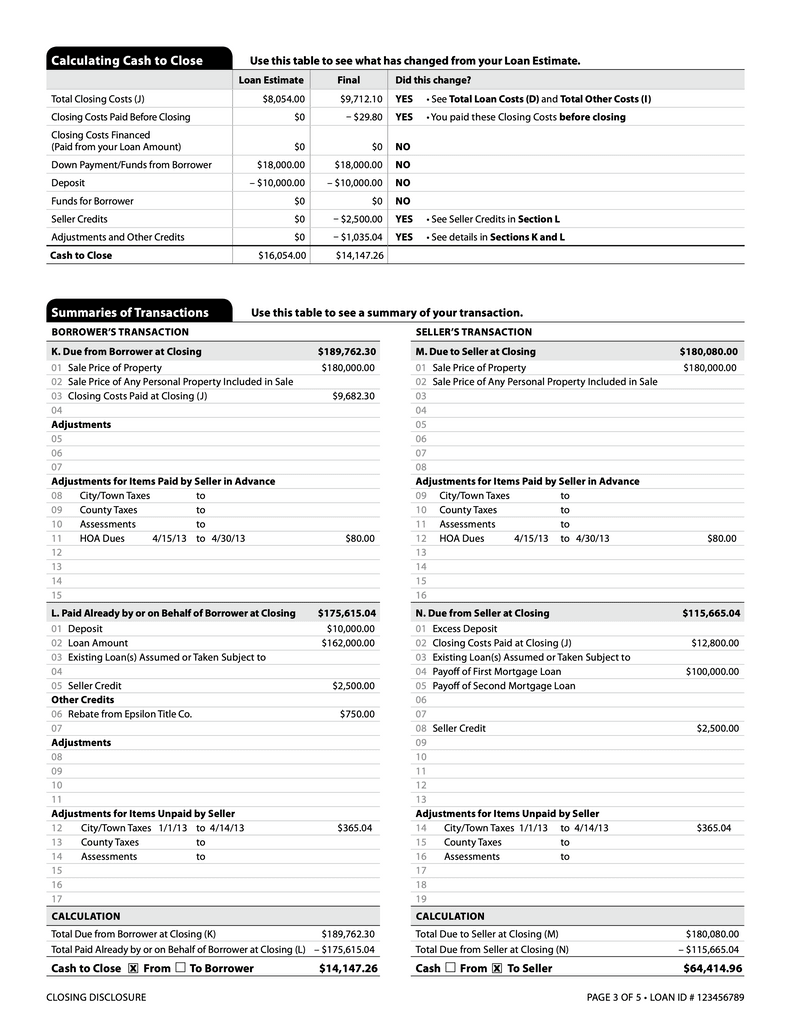

Page 3

Page 3 is a rundown of the fees you need to pay at closing. It explains which fees changed from the loan estimate, and includes any seller credits you negotiated.

It also includes a detailed summary of the transaction for both the buyer and the seller.

Similar to Page 2, reviewing this line by line is important to ensure it’s accurate. Be sure to verify your down payment, the amount you’re borrowing, and the application of any credits — such as your earnest money deposit — to the down payment or closing costs.

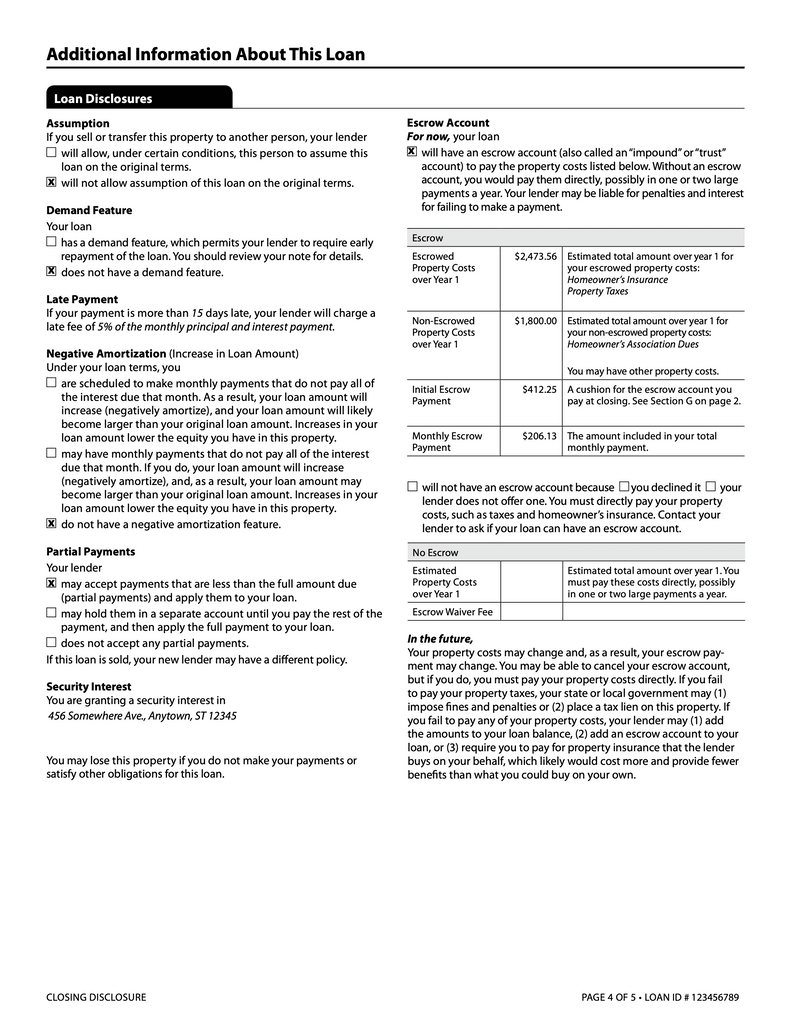

Page 4

Page 4 is for loan disclosures, which include details for making payments, when and how late fees are applied, and paying costs such as property taxes and homeowners insurance through an escrow account.

It’s important to verify the amount going into your escrow account, as well as what the penalties look like if you’re unable to make a full monthly mortgage payment on time.

If your lender does not offer escrow accounts to pay for your homeowners insurance and property taxes, you need to be prepared to pay those bills separately and on time.

Pay special attention to the demand feature, which indicates if the lender can demand early repayment of the loan.

It’s also worth double-checking the negative amortization feature, as this may allow your mortgage balance to increase beyond the value of the home.

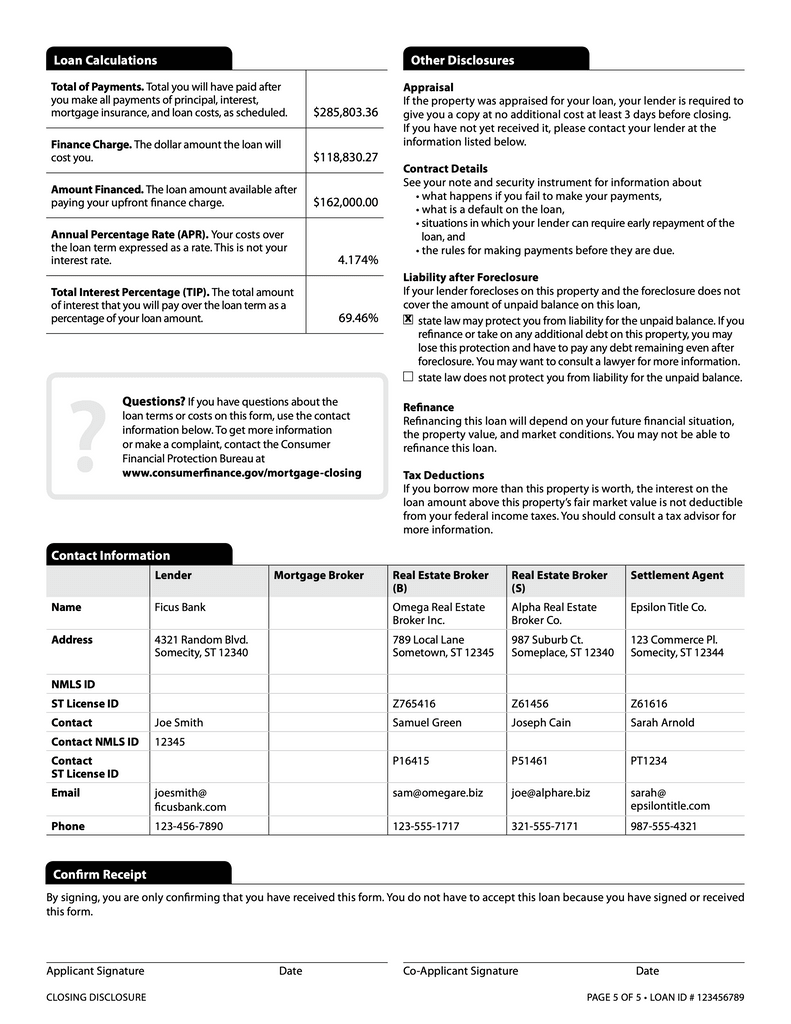

Page 5

The last page explains the big picture of your loan. This covers how much you’ll pay in total over the life of the loan, including how much interest you will pay.

This page also will have contact information for the lender, the mortgage broker, both real estate brokers, and the title or settlement company.

Here’s what your itemized breakdown should look like:

- Total payments. Number of payments needed to pay off all principal, interest, loan costs, and mortgage insurance

- Finance charges. Total cost of the loan

- Amount financed. Total loan amount after finance charges

- APR. Total cost of loan expressed as a percentage rate

- Total interest percentage. Full cost of interest for the loan

You sign the closing disclosure only to confirm its receipt. You don’t legally accept the loan and its conditions until you sign the mortgage documents at closing.

Download a sample closing disclosure form here.

Loan Estimates vs. Closing Disclosures

Before signing your closing documents, it’s important to compare the loan estimate and the closing disclosure to be sure you fully understand the loan terms.

Which costs can change?

It’s important to remember that lenders are not entirely in control of all closing costs, and your interest rate can change if it’s not locked in.

Fees that may change between the time you receive your loan estimate and closing include:

- Insurance premiums

- Escrow payments

- Prepaid interest

- Optional service fees

- Recording fees

There’s a gray area when it comes to fees for required services. Costs are locked in only if the provider is an affiliate of the lender. Fees for service providers can change even if they are on the lender’s preferred list.

Which costs cannot change?

Fees that should not change include:

- Appraisal fees

- Lender fees

- Origination charges

- Underwriting fees

- Transfer taxes

If you find unexpected changes, contact your lender or settlement agent immediately to have the issue corrected.

What To Do If the Closing Disclosure vs. Loan Estimate Differs

It’s important to compare your closing disclosure with your loan estimate. If they differ, contact your lender immediately and ask it to explain the changes.

Keep in mind that even if you don’t have a change of circumstances, certain closing costs still can change between the loan estimate and the closing disclosure, such as:

- Prepaid interest, homeowners insurance premiums, initial escrow account deposits, fees for services you have shopped for separately, as well as fees for optional third-party services can increase by any amount.

- Costs or fees for third-party services that the lender requires may increase no more than 10% from the loan estimate.

- Interest rates can change at any time without a rate lock.

Transfer taxes, fees paid for services required by the lender or mortgage broker, and fees for required services you could not shop for cannot be increased from the loan estimate.

If your costs have increased beyond the allowed limits, you are entitled to a refund of the amount you paid over those limits.

FAQ: Loan Estimate vs. Closing Disclosure

Check out the answers to these common questions about loan estimates and closing disclosures.

There is technically no limit to the number of loan estimates you can receive because an estimate is not a binding agreement. It’s recommended that buyers seek out at least three estimates to compare offers. The Consumer Financial Protection Bureau says that borrowers who shop around for a mortgage can save up to $1,200 over the life of their loan.

While you can’t be forced to take a loan after signing a closing disclosure, you still may have to pay application fees. Your credit also can take a hit, and you may forfeit your earnest money deposit. All of these things can affect your ability to move forward with buying another property.

The Bottom Line on Loan Estimates vs. Closing Disclosures

The loan estimate and the closing disclosure are two of the most important documents to review when getting a mortgage to buy a home. The loan estimate comes early in the process to outline the loan terms and your obligations in paying back the loan. The closing disclosure outlines the final terms of your loan and the transaction, which you accept when you sign your closing documents. Be sure to review thoroughly each document, so you can be confident about finalizing the purchase of your new home.

Adam Luehrs contributed to the reporting of this article.

- Freddie Mac (2023)